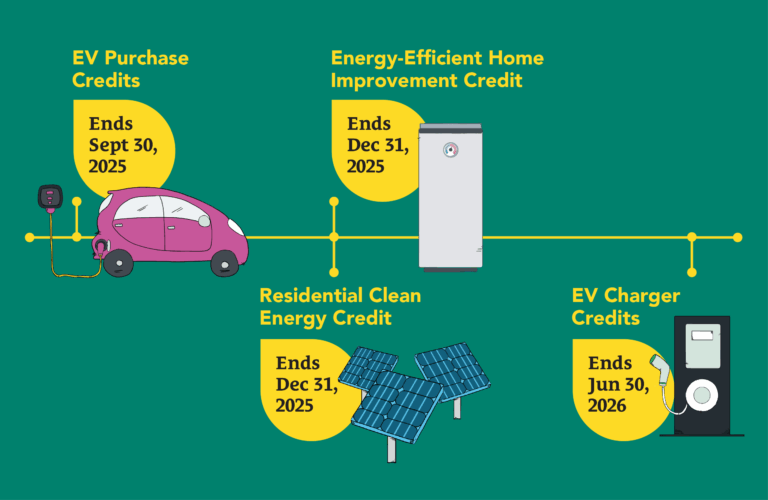

If you’re ready to go solar, buy an EV, or upgrade your home heating and cooling, here’s a list of federal clean energy tax credits you’ll want to use before they end. Stack them with MCE incentives to save even more!

Homeowners

If you’re planning solar, battery storage, energy-efficient upgrades or EV/charger installation, make sure that you start and complete the project by the applicable deadline.

Federal tax credits

Residential Clean Energy Credit

- 30% tax credit for solar panels, battery storage, small wind turbines, geothermal heat pumps, fuel cells, solar water heaters.

- Ends on December 31, 2025. Projects must be installed and commissioned by that date to qualify.

Energy-Efficient Home Improvement Credit

- 30% off heat pumps, water heaters, insulation, HVAC, doors, windows, energy audits.

- Ends on December 31, 2025. Upgrades must be placed in service by then.

MCE incentives

Residential Flex Market

- Up to $4,600 in rebates for your heat pump water heater project.

- Additional rebates are available for other energy efficiency projects.

- If your gas water heater dies, your contractor can temporarily install a gas replacement until they can make wiring changes needed to switch to a high-efficiency electric heat pump water heater. And they can earn a $1,500 rebate from MCE. Share this resource with your contractor.

Emergency Water Heater Loaner Program

- If your gas water heater dies, your contractor can temporarily install a gas replacement until they can make wiring changes needed to switch to a high-efficiency electric heat pump water heater. And they can earn a $1,500 rebate from MCE.

- Share this with your contractor.

MCE Solar Storage Credit

- Save up to $20 per month on your electric bill simply by setting your home battery to discharge daily during peak hours, from 4-9 p.m.

- Check your eligibility.

EV buyers

Stack MCE’s EV Instant Rebate with the federal tax credits and for up to $11,000 off a qualified new or up to $6,000 off a qualified used EV.

Federal tax credits

EV Purchase Credits

- Up to $7,500 for new EVs and $4,000 for used EVs, subject to income limits.

- Ends on September 30, 2025. The vehicle must be purchased and placed in service by that date.

MCE incentives

EV Instant Rebate

- $3,500 instant rebate for purchasing or leasing a new EV or plug-in hybrid.

- $2,000 instant rebate for purchasing or leasing a pre-owned EV or plug-in hybrid.

- See if you qualify.

MCE Sync EV Smart Charging App

- Earn a $50 sign-up bonus and up to $10 per month cash back when you hook up this app with your home EV charger. The MCE Sync app helps you automate your EV charging at home to use the least expensive and cleanest energy on the grid.

- Download the app.

Property managers

Federal tax credits

EV Charger Credits

- Offers 30% credit (up to $1,000) for installing home EV chargers and related electrical equipment.

- Ends on June 30, 2026. Upgrades must be placed in service by then.

MCE incentives

Stack federal EV Charger credits with MCE’s EV charger rebates, which provide up to $4,500 per port.

If your project is in Marin, you can receive up to an additional $3,000 per L2 charging port and $750 per L1 charging port for the public sector from the Transportation Authority of Marin’s Alternative Fuel & Electric Vehicle Program.

Ready to act?

You may qualify for additional state and local incentives on top of federal tax credits and MCE incentives. Use MCE’s Rebate and Incentive Finder to get the full list of ways that you can save.

Blog by Shyna Deepak